Bangladesh’s economy is now at a transitional point of development. The economy of the country is shi. ing from informal agro-based to manufacturing-based formal sectors.

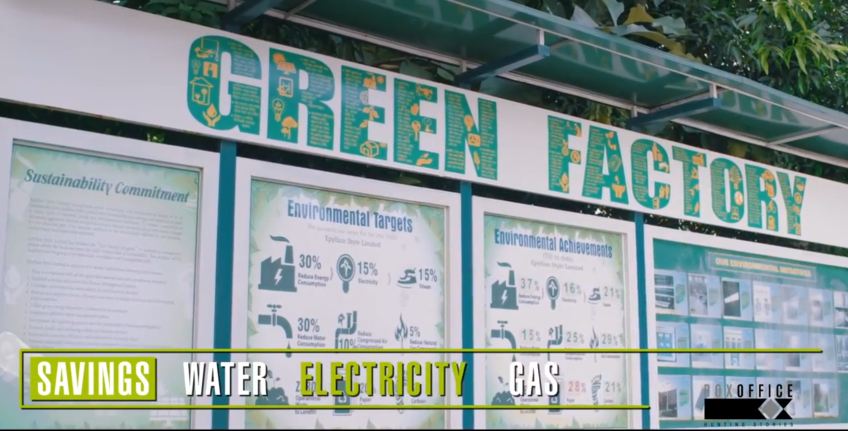

Over the last few decades the industrial sector achieved remarkable growth mostly through RMG and textile sector. Standing in a crucial point like this the significance of environmental sustainability cannot be overlooked. Going green has now become a must to achieve environmentally sustainable development.

The good news is that the garment industry of Bangladesh has steadily stepped into eco-friendly business. Already a number of state-of-the-art green factories have been established within the country.

A total of 86 garment factories have so far received LEED (Leadership in Energy & Environ- mental Design) certificates from United States Green Building Council (USGBC) for their extraordinary green practices. Out of the 86, 23 garment factories have achieved Platinum LEED, the highest category of the USGBC certification. Moreover, about 300 more garment factories of the country has already registered in the USGBC for the green certifications.

The environment of Bangladesh is governed by Environmental Conservation Rule 1997 which is enforced by Department of Environment (DoE) under the Ministry of Environment and Forests (MoEF).

In the sixth five year plan, the government has included zero discharge implementation as a KPI of DoE. The DoE is now in a phase of revising ECR’ 97 and asking for zero discharge plans from the factories while renewing Environmental Clearance Certificate (ECC) which is also a great stride towards environmental sustainability.

Bangladesh Bank has been playing a pivotal role in promoting sustainable industrialization through green financing. It has introduced three types of refinancing facility -- BB refinance scheme, Asian Development Bank (ADB) supported refinance scheme, and refinance

scheme funded by Shari’ah based banks and financial institutes.

Interest rate for these green loans varies from 6% to 9% depending on the banks capacity interest and relation with their clients. As per the decision of the central bank, all the banks and financial institutions have to disburse 5% of their total loan in green financing.

Bangladesh Bank is also offering loans under the Export Development Fund (EDF) at subsidized rates, which entrepreneurs can avail. The maximum amount that can be borrowed by an individual borrower has also been increased to $20 million for export-oriented garment Manufacturers.

As making a factory green requires a substantial amount of money, access to low-cost finance can encourage the entrepreneurs to adopt more environ- mentally sustainable technologies and practices at their factories, the provisions of the Bangladesh Bank are playing the role of catalyst in the country’s green garments growth.